Despite inflationary pressures and supply chain disruptions, the global offshore wind market has seen a 7% increase in new capacity additions compared to the previous year, according to analysis by Rystad Energy.

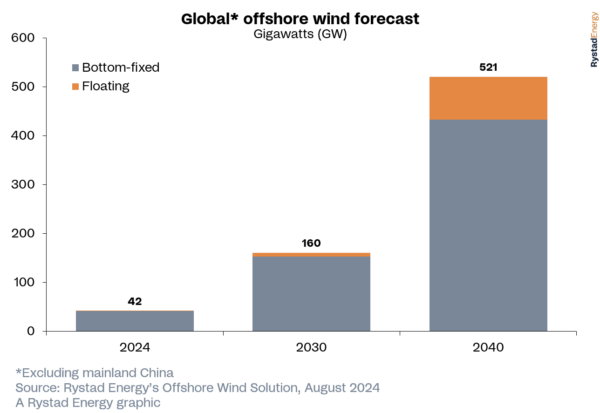

Rystad Energy expects momentum for the offshore wind sector to continue at a steady pace, and estimates that global installations, excluding mainland China, will exceed 520GW by 2040.

Related article: Australia needs large-scale energy production—here are three reasons why offshore wind is a good fit

“Europe will play a crucial role in this growth, relying heavily on floating wind to meet ambitious national targets and make the most of its abundant offshore resources. By 2040, the continent is expected to account for more than 70% of global floating wind installations,” Rystad reports.

“Although some project delays beyond 2030 are anticipated, there will likely be a strong push to accelerate deployment. As a result, floating wind capacity is projected to approach 90GW by 2040, with the UK, France and Portugal at the forefront of development.

“Asia will also be key in advancing floating wind as a mature technology, and the region— excluding mainland China—is expected to capture a share of 20% of global installations by 2040.”

While there has been a recent rise in floating wind project announcements, the sector is still grappling with supply chain constraints similar to the bottom-fixed segment, where wind turbines are installed on fixed foundations in shallow waters.

These challenges could hinder the advancement of floating wind technology in the short term, with capacity estimates of less than 7GW by 2030. To overcome these hurdles, Rystad says increased government support is crucial.

In the bottom-fixed market, the analysis pegs the UK, Germany and the Netherlands to emerge as the three dominant players.

Related article: Aussie innovation spearheads testing for offshore wind farms

Rystad Energy’s long-term forecast for the floating wind sector differs significantly from the upward trend observed in the bottom-fixed market.

From 2025 to 2030, it anticipates only Asia and Europe will be actively installing floating wind capacity. By 2030, it expects Europe to have installed almost 5GW of floating wind, while Asia, excluding mainland China, is projected to add 2GW.

Read the full ananalysis here.