Oil and gas giant Woodside has completed its sell-down of a 40% interest in its Louisiana LNG facility to investment firm Stonepeak.

Stonepeak will provide US$5.7 billion towards the expected capital expenditure for the foundation development of Louisiana LNG on an accelerated basis, contributing 75% of project capital expenditure in both 2025 and 2026.

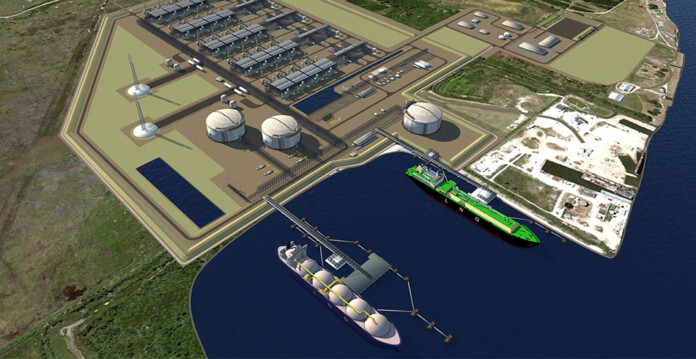

Related article: Woodside approves Louisiana LNG project in the US

Woodside CEO Meg O’Neill said Stonepeak would add further value to the Louisiana LNG project.

“Our partnership with Stonepeak reflects the attractiveness of Louisiana LNG and was a key milestone towards achieving a successful final investment decision. Stonepeak is a high-quality partner, with extensive investment experience across US gas and LNG infrastructure.

“The accelerated capital contribution from Stonepeak enhances Louisiana LNG project returns and strengthens our capacity for shareholder returns ahead of first cargo from the Scarborough Energy Project in Western Australia, targeted for the second half of 2026.

“We continue to see strong interest from additional potential partners in Louisiana LNG.”

Related article: New legal challenge for Woodside’s North West Shelf

Stonepeak senior managing director and head of US private equity James Wyper said, “Louisiana LNG will be a timely and strategic addition to the US LNG export landscape as the world’s demand for cleaner, more flexible and more affordable energy continues to grow.

“We look forward to contributing our expertise and capital to the construction and future operation of Louisiana LNG and are highly energised to continue supporting the development of critical North American LNG infrastructure with global impact.”